What is PMJDY (Pradhan Mantri Jan Dhan Yojana)?

Government of India is running a financial inclusion program Jan Dhan Yojana for the citizen of India. The main objective of this Prime Minister Scheme is to provide an easy access to financial services like bank accounts, insurance, pension, and remittances for the growth of country and empower citizens of India. This scheme is operated by the Department of Financial Services and Ministry of Finance. On the inauguration day of this Jan Dhan Yojana, 15 million bank accounts were opened.

According to Pradhan Mantri Jan Dhan Yojana, the account will be opened at zero balance in post offices and other nationalized banks. Those people who linked their Aadhar Card with the bank account, they will get the facility of overdrafts, and RuPay Debit Card after completion of 6 months. The holders of RuPay Farmer Debit Cards will additionally get a one lakh accidental insurance.

When Was Pradhan Mantri Jan Dhan Yojana Launched?

Jan Dhan Scheme was announced on Independence Day of 2014 (15 August 2014). The Pradhan Mantri Jan Dhan Yojana (PMJDY) initiative was launched by the Prime Minister of India Narendra Modi on 28th August 2014. Prime Minister described the PM Jan Dhan Scheme as a festive occasion to commemorate the liberation of poor.

Prime Minister Jan-Dhan Yojana 2021 Highlights

Name of Scheme – Pradhan Mantri Jan Dhan Yojana

Launched By – Prime Minister Narendra Modi

Announcement Date – 15 August 2014

Launched Date – 28 August 2014

Minimum Balance – Zero Balance Account

Interest Rate – Based on Interest Rate Offered by Bank for Saving Account

Accidental Insurance – Under RuPay Scheme (Rs. 1 Lakh), Accounts Opened after 28 August 2018 (Rs. 2 Lakh)

Overdraft Facility – Provided

Facilities of Pradhan Mantri Jan Dhan Yojana

- Under PMJDY, a person can open saving accounts.

- There is no need to maintain the minimum balance in the bank accounts opened under this scheme.

- Account holders will also get the interest as offered by the respective bank.

- An account holder gets the RuPay Debit Card.

- Under Pradhan Mantri Jan Dhan Yojana, an additional insurance of 2 lakhs is offered by the Government. The Account Holder will only get the benefit of accidental insurance if the user is used the RuPay Debit Card.

- According to this scheme, 30,000 life insurance is also provided to the account holder.

- You will get an overdraft facility of Rs. 10000/- , but to avail this facility the account is linked with Aadhar Card.

Pradhan Mantri Jan Dhan Yojana Benefits

- Citizen of India can open an account under this scheme. The minimum age of an account holder can be 10 years.

- According to Pradhan Mantri Jan Dhan Yojana, account holder get advantage of Rs. 1 Lakh accidental insurance.

- Interested candidates can get a loan of Rs. 10000/- without any paper work under this Prime Minister Jan Dhan Scheme.

- If account holder demands for a cheque book, then he need to fulfill the requirement of minimum balance.

Pradhan Mantri Jan Dhan Yojana Eligibility

- Must be a citizen of India

- Age should be at least 10 years

- Person should not have a bank account

Documents Required for Pradhan Mantri Jan Dhan Yojana

- Aadhar Card

- Identity Card

- Driving License

- Pan Card

- Mobile Number

- Passport Size Photo

- Address Proof

- Passport

- Permanent Account Number (PAN) Card

- The National Rural Employment Guarantee Act (NREGA) issued job card

- Voter ID

How To Apply A Pradhan Mantri Jan Dhan Yojana?

- Interested candidates in Pradhan Mantri Jan Dhan Yojana can visit the nearest bank and get an application form to open a Jan Dhan Bank Account. You can also get the application from the official website of PMJDY (https://www.pmjdy.gov.in/scheme).

- Fill the all required details asked in the application form such as details of yourself, nominee, and bank where you are opening the account.

- After completing the form attach the copy of required documents.

- Submit the application form and required documents to the bank officer.

- Once the account opening form process is done by the bank officer, your Jan Dhan Account will be open.

Pradhan Mantri Jan Dhan Yojana Contributors

- Makes The Banking Facilities Easier

- Financial Literacy Program

- Micro Credit Facility

- Micro Insurance Benefit

- Pradhan Mantri Jeevan Bima Yojana

- Pradhan Mantri Suraksha Bima Yojana

- RuPay Debit Card

Banks That Provide Prime Minister Jan Dhan Scheme

Private Sector Banks who offers PMJDY Yojana

Dhanalaxmi Bank Ltd.

YES Bank Ltd.

Kotak Mahindra Bank Ltd.

Karnataka Bank Ltd.

ING Vysya Bank Ltd.

Indusind Bank Ltd.

Federal Bank Ltd.

HDFC Bank Ltd.

Axis Bank Ltd.

ICICI Bank Ltd.

Public Sector Banks who offers PMJDY Yojana

Oriental Bank of Commerce

Union Bank of India

Allahabad Bank

Dena Bank

Syndicate Bank

Punjab & Sind Bank

Vijaya Bank

Central Bank of India

Punjab National Bank

Indian Bank

IDBI Bank

Corporation Bank

Canara Bank

Bank of India

Bank of Maharashtra

Andhra Bank

Bank of Baroda

State Bank of India

How To Check The Balance Of Jan Dhan Yojana Account

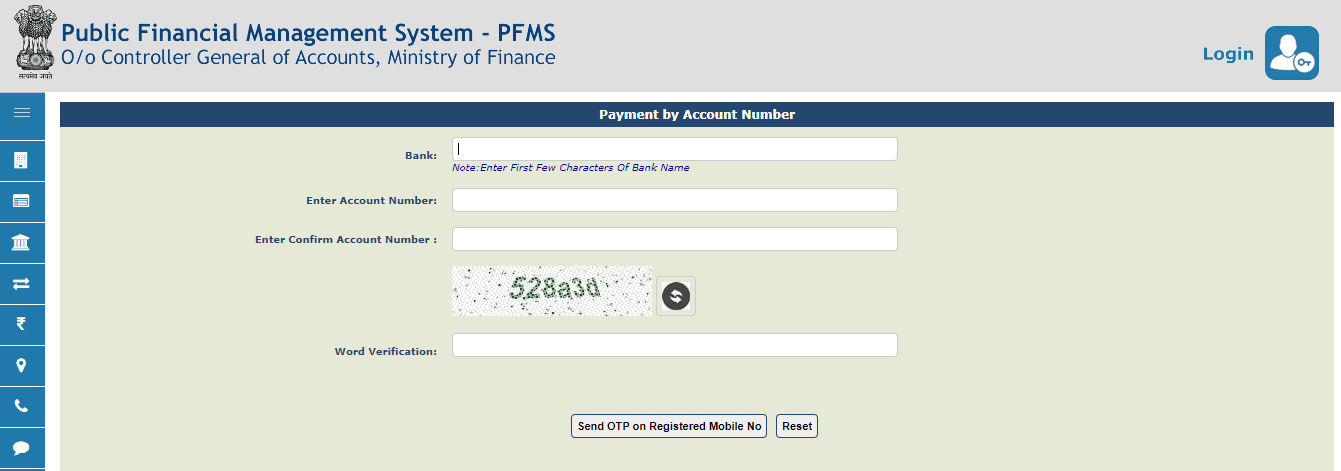

To check the PMJDY account balance via PFMS Portal –

- Visit the official website of Public Financial Management System (PFMS).

- Click on ‘Know your Payments’ option & fill the details.

- After filling the details click on ‘Send OTP on Registered Mobile No.’ You will receive an OTP.

- Enter the received OTP and you can see your account balance.

To check the PMJDY account balance via Missed Call –

To know the PMJDY account balance, give a missed call on 18004253800 or 1800112211 from your registered mobile number.